Here are some morning market thoughts from Flashpoint’s Darius Lechtenberger:

WTI crude oil and refined product prices are climbing this morning, driven by ongoing concerns over Russian and Iranian supply constraints due to sanctions. Despite fears that escalating trade tariffs could slow global economic growth—potentially prompting OPEC+ to extend current production quotas—demand for crude oil and refined products remains strong. While markets worry about tariffs dampening growth, the crude and refined fuel markets are signaling resilience. Meanwhile, propane prices are also on the rise, supported by forecasts of below-normal temperatures extending through March.

John Kemp offers the latest on hedge fund activity in the oil and gas space:

“Investors sold petroleum for the second week running as the threat of an international trade conflict dampened the outlook for oil consumption and snuffed out the bullishness that had taken hold since the start of the year. Tariff escalation between the United States and its major trading partners (actual or threatened) is likely to disrupt supply chains and prolong inflation. The prospect of a renewed downturn in global manufacturing, persistent price increases and interest rates remaining higher for longer has unnerved investors. Bullish optimism about a strong cyclical recovery in the major economies boosting oil consumption has given way to more caution.

Of all the six major contracts, investors only hold a bullish position in Brent (290 million barrels or 73rd percentile). Positions in the rest were either mildly bearish, in the case of U.S. diesel (36th percentile) and U.S. gasoline (34th percentile), or very bearish, in the case of WTI (11th percentile) and European gasoil (11th percentile). Brent has drawn some support from the threat other countries will retaliate by imposing tariffs on crude exported from the United States, something China has already done, lifting demand for replacement crudes. More broadly, however, tariff and trade wars are expected to have a negative impact on industrial activity and boost inflation in the short term, both of which are likely to have negative consequences for fuel use.”

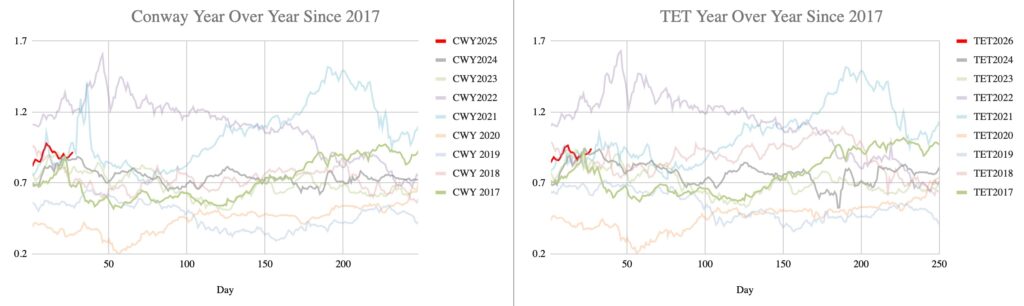

Propane values remain strong, and getting stronger with a colder to much colder than normal forecast predicted for most of the country. As the image below shows, TET flat price is at its second highest level for this time of year since 2017, while Conway is near its second highest levels.