We begin with a note from Flashpoint’s Darius Lechtenberger:

“WTI crude oil and refined product prices are falling again this morning after a bearish day yesterday. Headlines have been suggesting that the U.S. and Iran are very near to finalizing the details of a new Iran nuclear agreement…I continue to be skeptical as history suggests that Iran will revert to past shenanigans and any progress made to date will be futile. If a deal does get done, don’t expect it to have much substance to it other than the lifting of sanctions which in theory will add more global crude supply thus helping to cool off energy prices. Industry experts do not think that adding current Iranian production back into the global market will have much effect as it has been documented that Iran is and has been selling their crude production to countries willing to look the other way regarding sanctions. Although, Iran has amassed a significant storage position while being sanctioned and these vast inventories would be a supply game changer for a short period of time…Outside of Iran there is significant bullish sentiment spread across the entire energy complex led by the Russia/Ukraine situation. A colder change to weather forecasts for the remainder of February have spurred on natural gas and propane prices to a higher level while detaching from the recent crude oil price weakness.”

As I was scanning news headlines this morning, I saw a report from Reuters that said there are estimated to be between 160,000 to 190,000 Russian troops on and near the Russian-Ukraine border, as of January 30th. The item suggested this was the most significant military mobilization in Europe since the second World War. Wow.

There is still a great deal of uncertainty as to which direction things will go there between those two countries, but it’s more than just two countries, as it’ a proxy Russia vs the West.

WTI closed at $91.76 yesterday and has traded below $90/bbl this morning, but is back above $91 as of this writing. There is just so much intraday and intra-week volatility in energy commodities these days…heck, it’s that way for most commodities. Propane is no different, as February hub prices have really been on a ride in recent days.

![]()

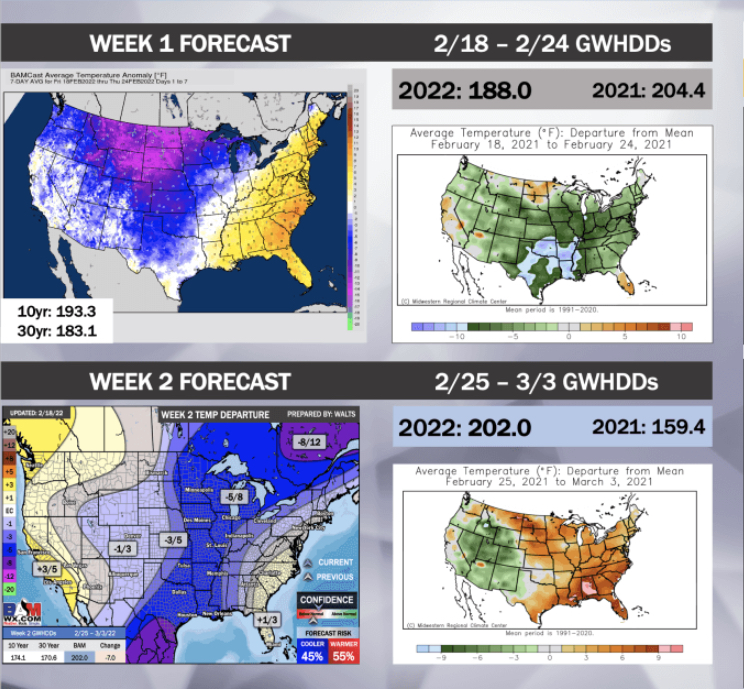

Weeks one and two is the top image, weeks three and four below that. All commentary from BAMWx.com. Today’s video discusses the next four week outlook. The next two weeks remain favorable for below normal cold for a good chunk of the country.

Week 1:

The below average temps mid-late week 1 will slowly migrate east with time, but also moderate *some*

We still fully anticipate parts of the Mississippi River Valley to see below average temps, however the cold is likely not as intense as it is for week 1 in the North Central US

The first few days of week 2 will be the period where the most below average air is expected to impact Texas and the South Central US

We are favoring a slight lean toward the GEFS with the week 2 forecast as we think the EPS is likely lingering the cooler air a bit too longer. If we had to make a call, we think that the EPS has room to trend warmer in week 2 some out ahead of storms (not seeing storm induced warmth great yet)

Week 2:

Behind this storm system yesterday, below average temps are being noted today across parts of the E US with heating demand near normal today and above normal tomorrow.

The cooler air does not last long as a warm up ensues for the Central and Eastern US for the weekend & very early next week, however this will not be long lived.

A strong system next Tue will pull down another round of Arctic air and lead to multiple days of temps running 20-30 degrees below average

During this period the E Coast will stay above normal, leading to heating demand ending up near average for the week.

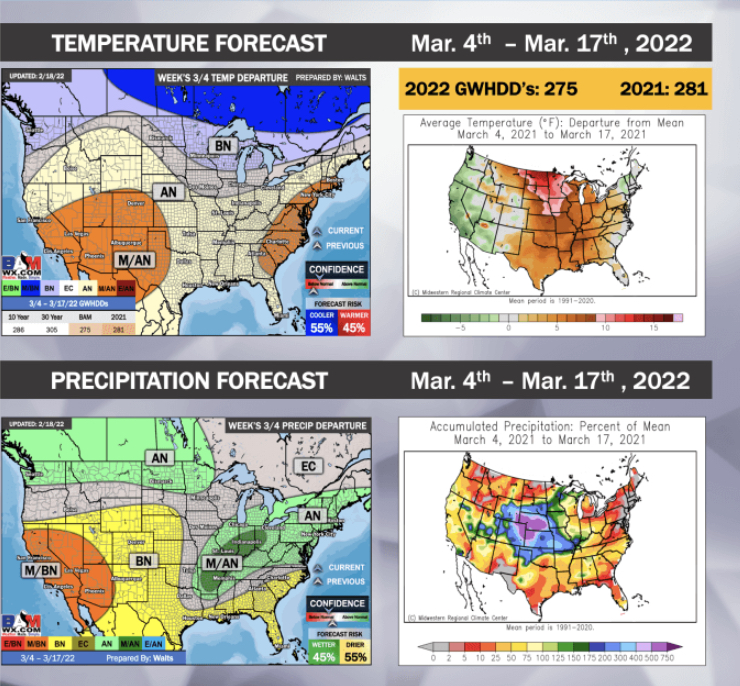

Week’s Three and Four

As we shift our weeks ¾ dates out of the first 3 days of the month and more into mid-month, we are expecting the Central US to gradually increase temps and bring above average air to the E US.

Need to watch the MJO closely as we do think the MJO can eventually work into phase 6 as we get more into early-mid March, while still feeling phase 5 at the very beginning of the month. As we work beyond Mar 5-10th, we do think that above normal temps will be at play given this progression.

The Northern tier of the US will likely continue to be an area that sits below average as the core of the above average air likely sits to the south.

We have kept the cooler risk as 55/45 as there are some drivers (MJO Phase 5) that is a slightly cooler risk. East Asia would suggest that very early week 3 could still be on the cooler side before warmer signals return in that 3/5 – 3/10 and beyond.