The United States along with much of the Western world has imposed sanctions on Russia over their invasion of Ukraine.

The United States, the European Union, Britain, Australia, Canada and Japan announce plans that target wealthy Russian oligarchs tied to President Vladimir Putin, as well as financial sanctions against Russian resources and banks.

President Biden said that any institution in Russia’s financial services sector is a target for additional sanctions. It’s important to note that more than 80 percent of Russia’s daily foreign exchanges and half of their trade is conducted in US Dollars. You can also see why foreign nations like Russia and China are eager to see the end of US Dollar dominance, and possibly why Putin recently embraced Bitcoin and Bitcoin mining, as the crypto currency operates outside of any government’s control.

From this linked item: “Washington sanctioned two of Russia’s state-owned banks – VEB and Promsvyazbank – and blocked it from trading in its debt on US and European markets. The two Russian banks are considered especially close to the Kremlin and Russia’s military, with more than $80bn in assets. That includes freezing all of those banks’ assets under US jurisdictions. Starting on Wednesday, the sanctions include the country’s “elites” and their family members, as well as civilian leaders in Russia’s leadership hierarchy.”

There were more sanctions against banks, Russian politicians and wealthy Russians tied to Putin, but Germany announced they were halting the process of certifying the Nord Stream 2 gas pipeline from Russian. This is a long-sought after deal that Russia has desired and was also something that was criticized by the United States for increasing Europe’s demand on Russia for its energy.

Germany, like other European neighbors, has been scaling back on coal and nuclear power generation as they march towards attaining ‘green goals’.

Russia supplies roughly 30 percent of Europe’s gas needs, and they did this even during the Soviet, Cold War era. I have yet to read any opinions that Putin will cut off gas to Europe, as those sales are a big portion of the Russian government’s revenues. HOWEVER….Russia could choose to raise prices on that gas, and Europe will still be in the grips of winter temperatures for the next several months.

When you combine the possibility of much higher energy prices along with global inflation and supply chain disruptions, you have another ingredient to add to the chaotic global stew we outlined yesterday.

Oh by the way, it appears the US and Iran are nearing the finish line relative to their nuclear talks and an agreement is expected to come soon.

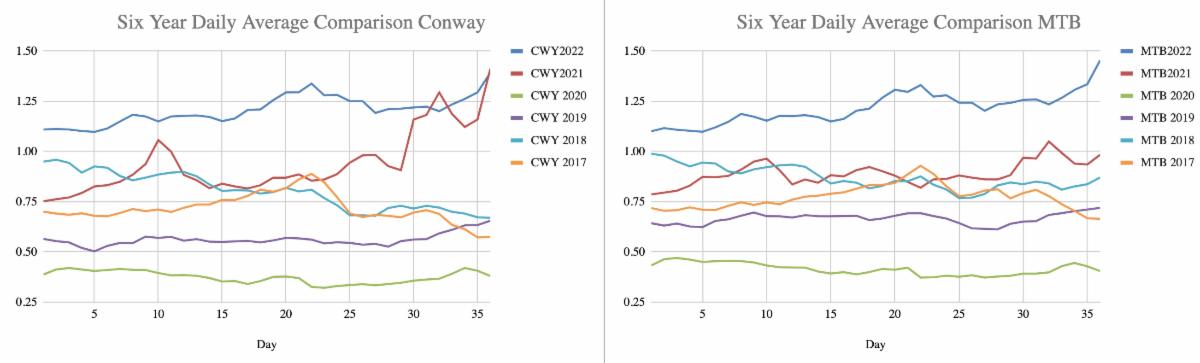

Oil prices are unchanged from yesterday’s close, while propane prices are also flat from yesterday’s closing averages…however, Conway’s daily average was just under $1.40/cpg while TET was just over $1.45/cpg. That was a ten cent jump from the previous close for Conway and $.12c for TET.

![]()

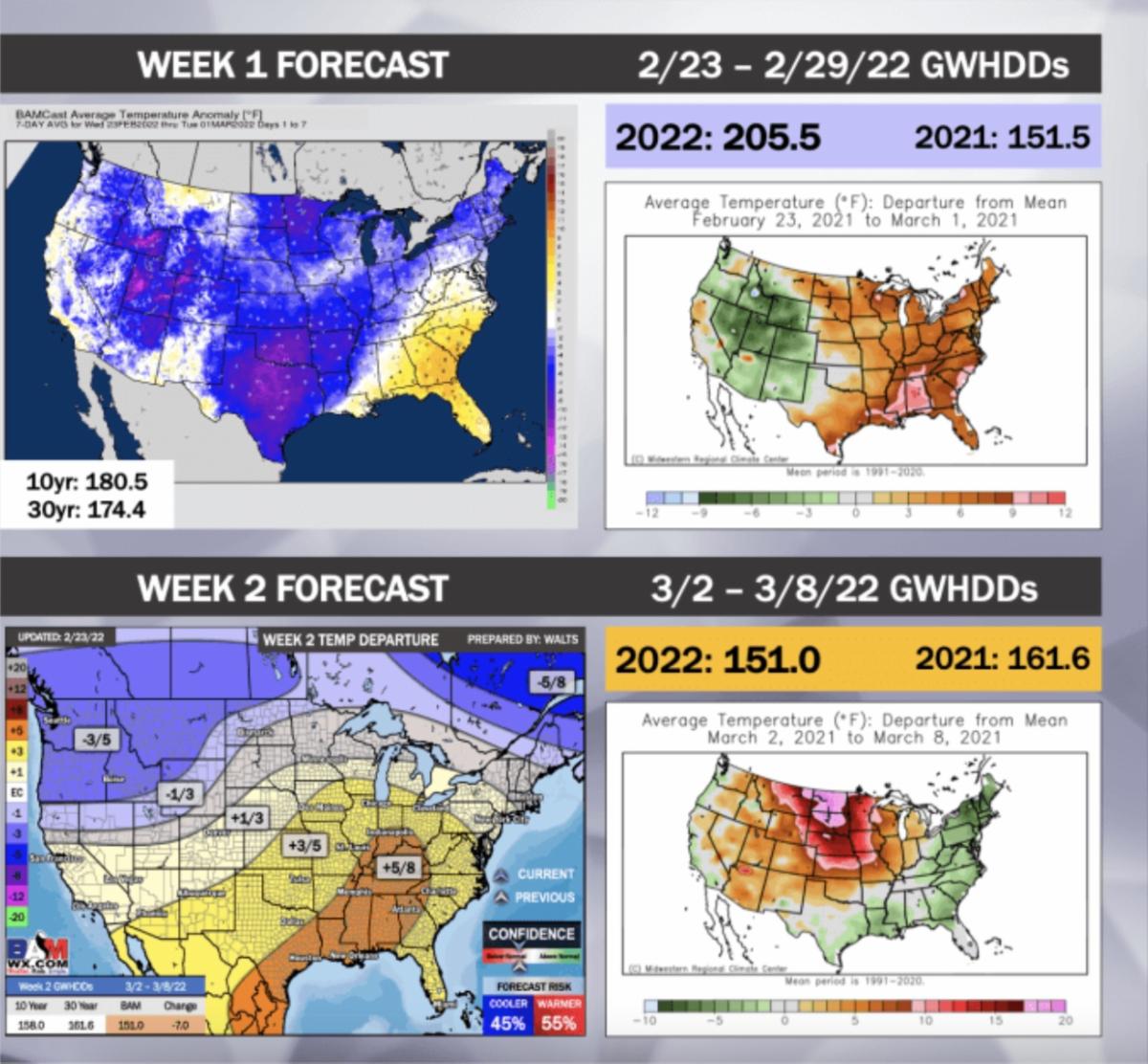

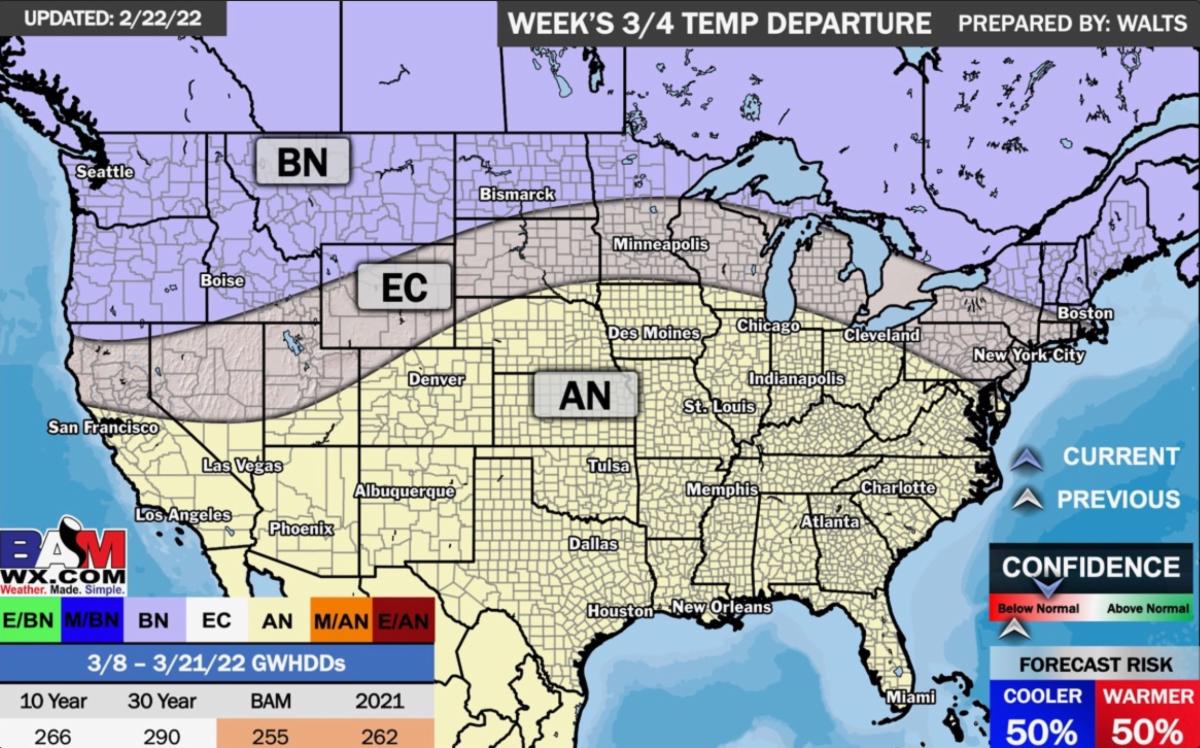

You can see the next four weeks laid out below relative to BAMWx’s forecast…another cold front is expected west to east the first week of March, but by and large, this outlook is warmer than normal as we wind down winter. The majority of today’s video from BAM focuses on their spring outlook, which will be of interest to those of you with agricultural ties.