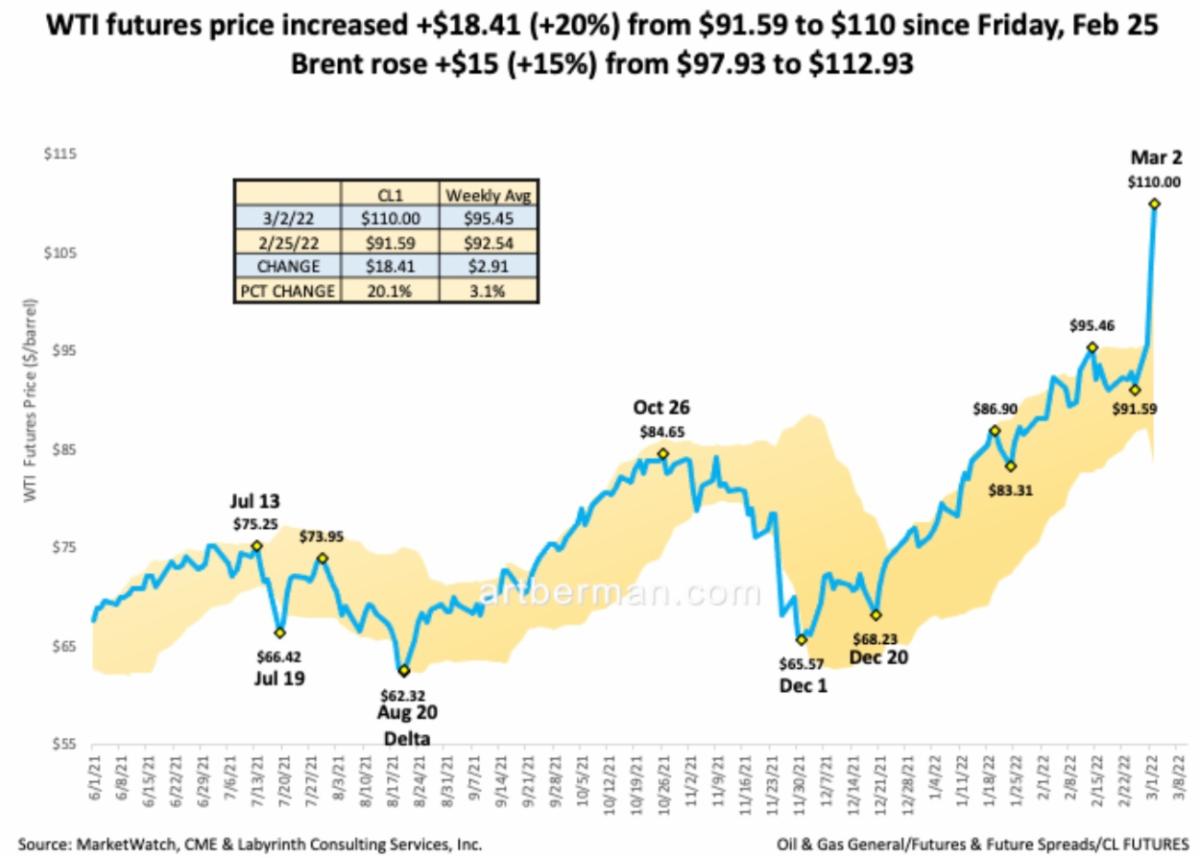

WTI crude oil closed at $110.60/bbl yesterday, its highest daily close since May of 2011. The May contract settled at $107.06. The front month contract traded over $116 around 2:30AM eastern time this morning, but is back below $110 as of this writing.

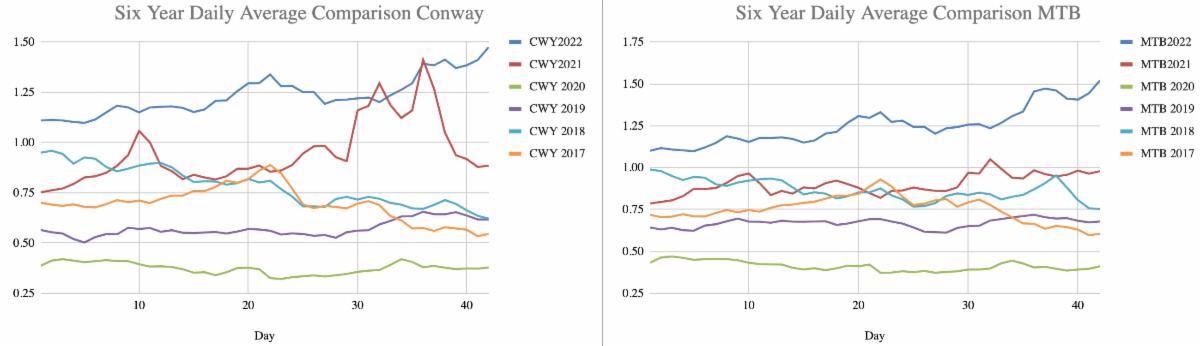

Conway averages jumped over $.0600/cpg yesterday with TET up over $.0700/cpg.

You can see in the image to the right how propane has ‘lost’ some value to crude oil, despite propane’s values moving much higher. It’s just that crude oil’s rise has been more steep than propane.

Propane is past the traditional peak domestic demand point on the calendar, which given that propane inventories are at an eight-year low point for this time of year, may be a blessing in disguise. That’s not to say that demand season is over, as another week to ten days of below normal temperatures are in the forecast. Propane exports will be a key aspect to monitor this month and into April as well, as the propane industry looks to begin rebuilding inventories from potentially the lowest levels in the shale era.

Those bullish fundamentals are in play behind the ongoing war in Ukraine and the Western world piling sanction upon sanction on Russia.

All of that is up against contract season in the propane industry, which has begun in earnest…the time of year when many retailers will be contracting for 2022-2023 supply, inking index volumes and lining things up for the coming year. There is seldom a dull moment in this industry.