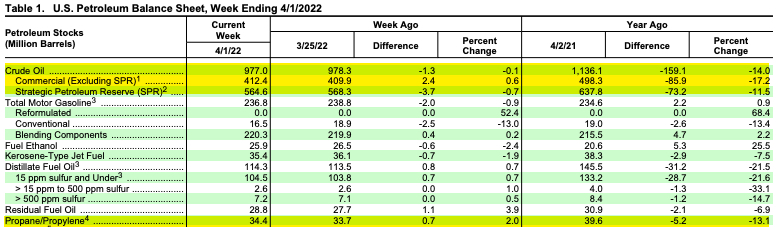

Propane inventories built 700,000/bbls for the week ending April 1st, 2022.

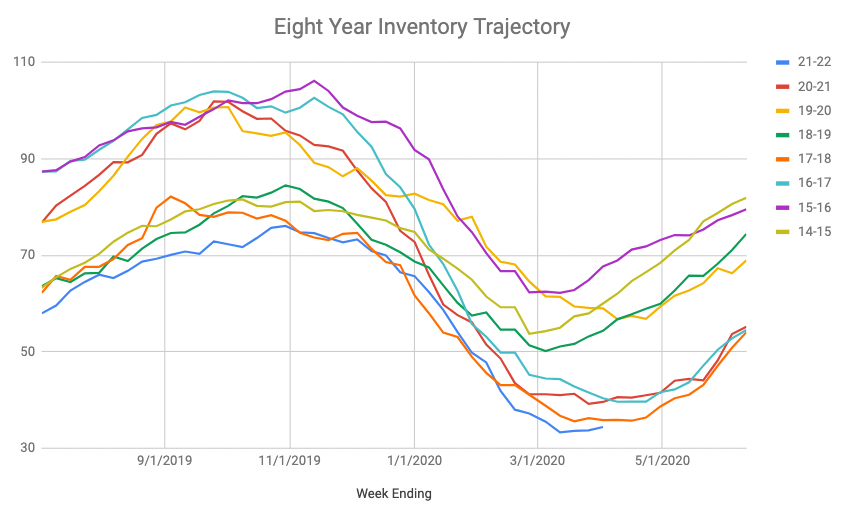

National inventory levels now sit at 34.4M/bbls, which is the low point for this time on the calendar for the past eight years. The next lowest year was 2018, with inventories listed at 35.83M/bbls. April of 2018 saw a few small week to week inventory draws, with an inventory level of 38.67 on April 30th, 2018. Those numbers included propylene, so I think it’s safe to say at this point on the calendar that propane only inventories were lower for this time of year in 2018 than they are now, with 2022 being the second lowest in the past eight years.

Exports bounced up a bit this week, checking in at 1.211M/bpd, while production was also stronger at 2.447M/bpd, where it had been averaging 2.35M/bpd the past four weeks

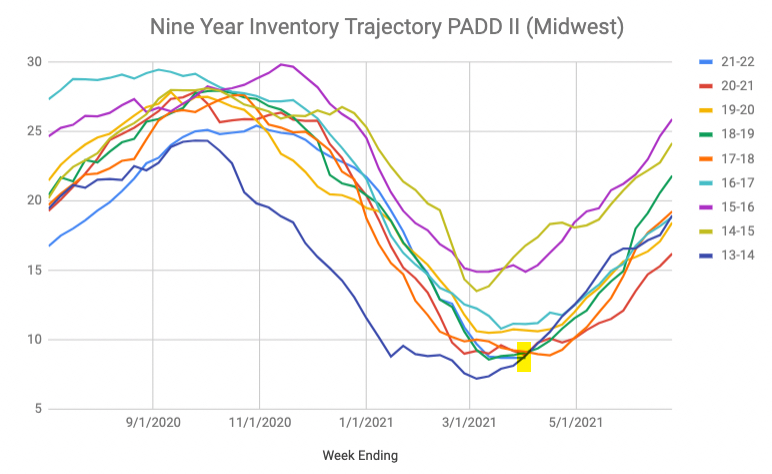

Midwest inventories were shown to be flat week over week at 8.7M/bbls. This is the third consecutive week of no-change in Midwest inventories.

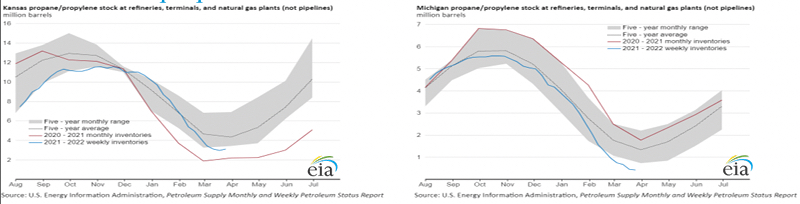

The next charts show propane inventories specifically in Kansas and Michigan. Kansas is where the Conway storage complex is located, essentially the supply backstop of the upper Midwest, whereas Michigan is the largest residential propane consuming state in the country. This was data from last week’s report, and show a very problematic outlook in Michigan. While there are no certainties in this industry, there is a concern that Michigan could see some strong basis/differential moves in the coming year unless the inventory situation there ‘heals’ drastically.