Good morning. Let’s dive in.

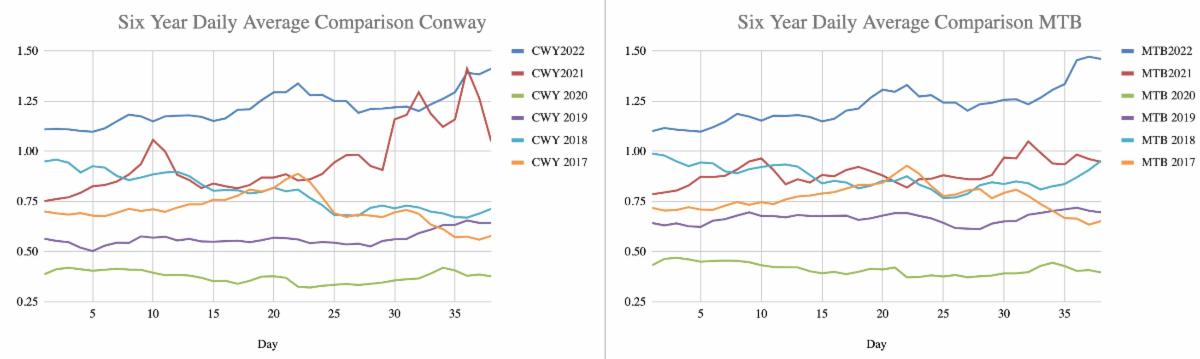

This item from Reuters talks about roiled energy prices due to the war in Ukraine. Yes, WTI did top $100 yesterday after closing at $92.10 on Wednesday, but it was brief and it closed at $92.81 by the end of the day, so it was quite the round trip trading day for crude yesterday. This was also the case for the financial and technical markets, just in the other direction; US markets were off sharply to begin the trading day but rebounded as the day went on. The NASDAQ was down 3.4% at one point yesterday but closed more than 3% higher. That was one of just eight trading days in the NASDAQ’s history where it was down over 3% at one point before closing higher. Propane was also higher, with Conway’s average closing over $1.41 for the first time since November. TET’s average was over $1.45, the first time it has seen that price point since October.

Lastly, here is an interesting write up from RBN Energy, talking about $100 crude and how long the elevated energy price environment could last. This, from the linked item, where RBN lists out some factors as to why they feel that even if peace comes to Ukraine, whatever that may look like, we could still be in an environment where oil bounces ‘in and out of triple digits’ for some time to come, which will impact propane prices. (the italicized words to follow are from RBN):

- “There’s good reason to believe that OPEC+ will stick to its guns and continue to inch up production by 400 Mb/d a month until all of the barrels being held off the market are flowing again.

- U.S. producers will respond to higher prices with modest production growth, but these gains will not be enough to move the needle in the global market.

- How about demand? Won’t higher prices result in demand destruction, taking some wind out of the market? Sure, there will be an impact, but not enough to offset the increases in demand coming from economies rebounding from COVID lockdowns. That will come along with more driving, more flying, and more goods being moved by truck.

- Higher prices beget higher prices…The short version is that when crude oil prices are increasing, the price curve moves into steeper backwardation, meaning prices are much higher in the short term than they are a few months out. That creates a disincentive to hold inventories, since the market is saying that prices will be falling in the future. So companies cut back on their inventories, which shows up in the market as a bullish signal as inventories decline. There are various chicken-and-egg scenarios to how this can play out, but it is certainly possible that the scenario can magnify price movements — in both directions.

- Finally, there is the elephant in the room: The energy transition…the illusion of a smooth energy transition was swept away in 2021, with the drive toward decarbonization running headlong into the reality of energy markets. As reinvestment in hydrocarbons slows and renewables and other decarbonized energy solutions don’t make up the difference, the obvious outcome will be supply/demand imbalances and higher prices. The handwriting is on the wall that this is the most likely outlook for the energy transition. The big question is how politicians deal with the higher energy costs that seem to be inevitable.”

This is just a snippet of the entire article, which I strongly recommend reading as it’s a well-worded overview. I even edited down these bullet points as to not sample too much from someone else’s work. When I share another word’s, it with the hope that you will click on the link and take a deeper dive into something that I feel can have an impact on your business, so please give the link above a click and spend about five minutes reading the entirety of this piece…it’s a good one.

![]()