First up, John Kemp’s look at hedge fund activity in the oil patch. While Hedge funds trimmed their long positions in crude oil last week, long positions still outnumber short positions 4.82 to 1, which is in the 62nd percentile dating back to all weeks since 2013. Kemp also made some comments in the article about fund managers selling middle distillates for the sixth-consecutive week, due to ‘deteriorating economic conditions’.

Some of that is likely China locking down several of its cities over new COVID outbreaks, but with inflation rising, and gas and energy prices soaring across the planet, at some point, demand destruction is likely to kick in. The IEA is already suggesting that global citizens look to cut back on their energy usage, carpool, work from home, etc, to reduce global crude demand.

Oil prices softened early last week before rising late in the week, but this morning sees another round of rises due to geopolitical events. WTI close at $104.70 on Friday but is trading north of $110 right now. Russian hypersonic missile attacks in Ukraine (the first such attack in real-war conditions for a missile with that speed capacity) along with militant rebels attacking a Saudi oil facility, again. The Saudi’s made a statement today saying they no longer have ‘responsibility for any shortage in oil supplies to global markets in light of the attacks on its oil facilities’.

The loss of production from today’s attack is not (at this time) deemed to be significant, but when the world is operating at the margins relative to spare capacity, and with the Russian invasion of Ukraine now at one-month on, it’s not going to take much to send oil, and propane prices back higher.

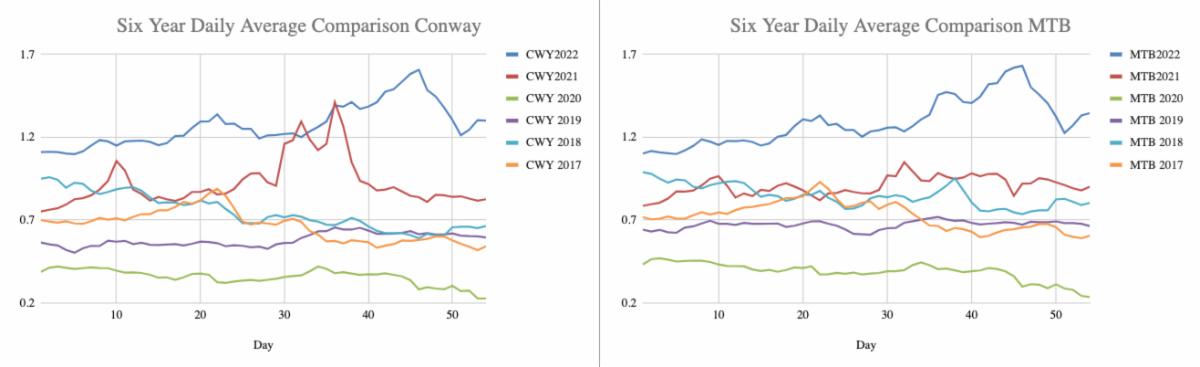

Propane values are up sharply this morning on the attack, with front month values back north of $1.4000/cpg at both Conway and TET.