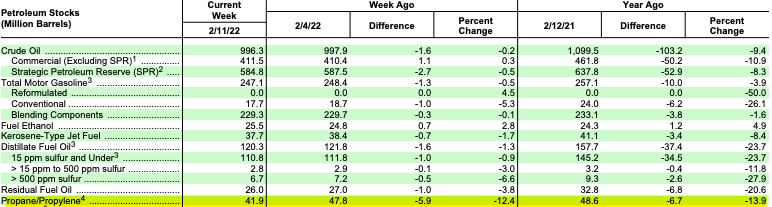

Propane inventories drew a whopping 5.9M/bbls for the week ending February 11th, 2022.

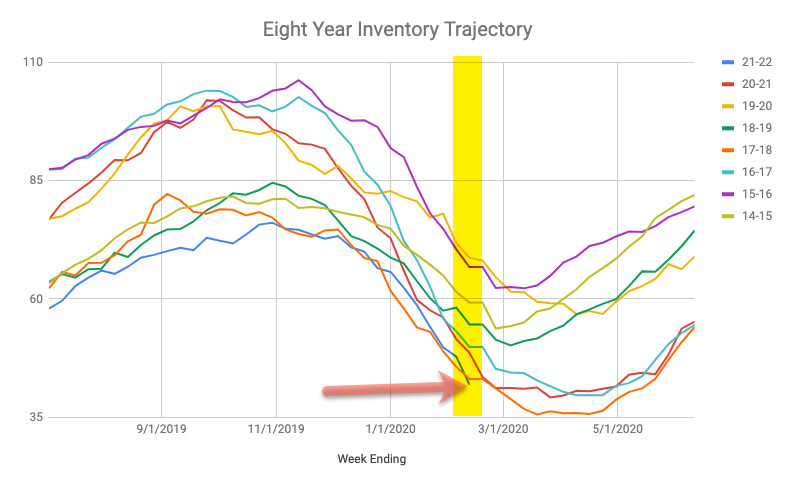

National inventories now stand at 41.9M/bbls, which is 6.7M/bbls lower than where inventories were reported to be this same week one year ago and also lower for this EIA reporting week than any other week in the past eight years.*

The * caveat represents the fact that current EIA data does NOT include propylene in the numbers, nor did last year’s data, but it did include such data before that. I’d still submit that while this same week in 2019 had lower propane only inventories in the national numbers, the the steep rate of inventory depletion over the past several weeks has been very impressive.

We have drawn 28.1M/bbls since Christmas. We drew 32.9M/bbls last year during the same period of time, but the weekly export averages last year were roughly 200,000/bpd more than they have been this year. However, domestic demand has averaged 1.949M/bpd during the same period this year, vs 1.823M/bpd one year ago during the same eight-week period dating back to Christmas.

The eight-week period from Christmas 2016 through February 10th, 2017 saw a draw of 39.3M/bbls, which is the most ever seen during this period, and was powered by very strong exports in a winter that was possibly more mild than this one.

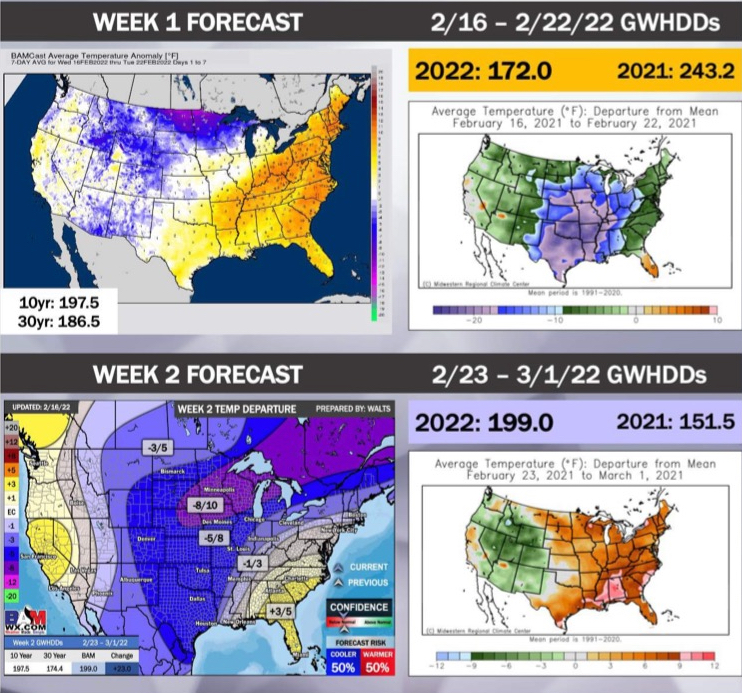

Having written all of that, inventories are sitting at 41.9M/bbls with two more reporting weeks left in February, and a forecast that has turned colder than what it looked like a week ago.

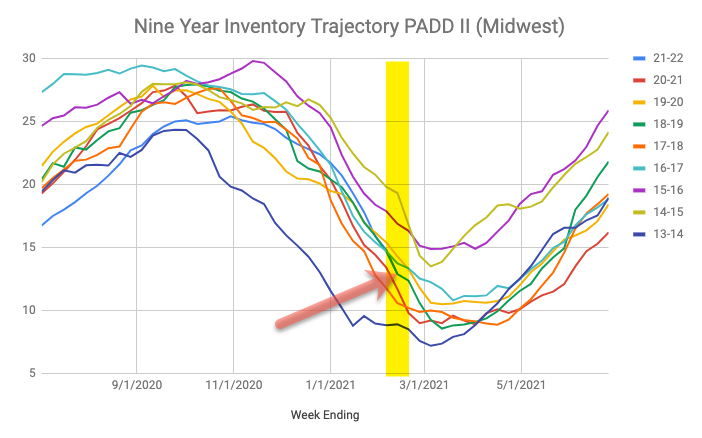

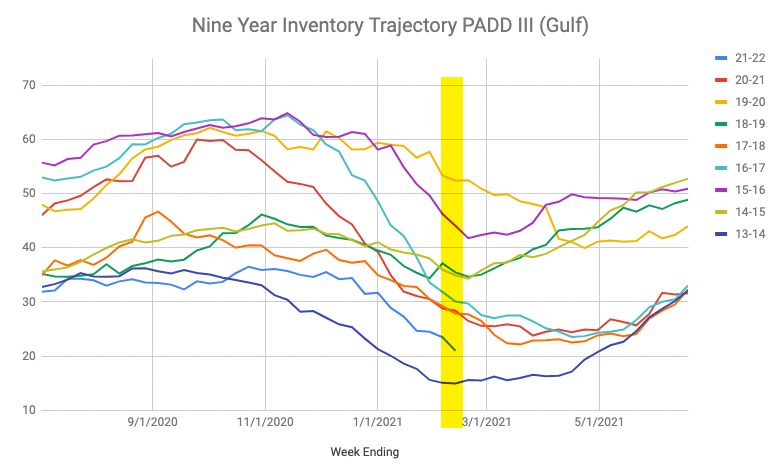

Midwest (PADD II) levels took a big move down this past week, dropping 1.9M/bbls (image lower left) while the Gulf saw a drop of 2.5M/bbls.

WTI crude up closed at $92.07 yesterday but was trading near $95 as of 10:20 AM central time. It seems very likely that this year’s inventory low will now be below 40M/bbls, which will be the third time in the past eight years. The lowest level was 35.6M/bbls during the third week of March, 2018 (propylene included) while last year’s low was 39.2M/bbls, reached the fourth week of March (no propylene). So for the second consecutive year, we will be building back inventories from historically low inventory levels.