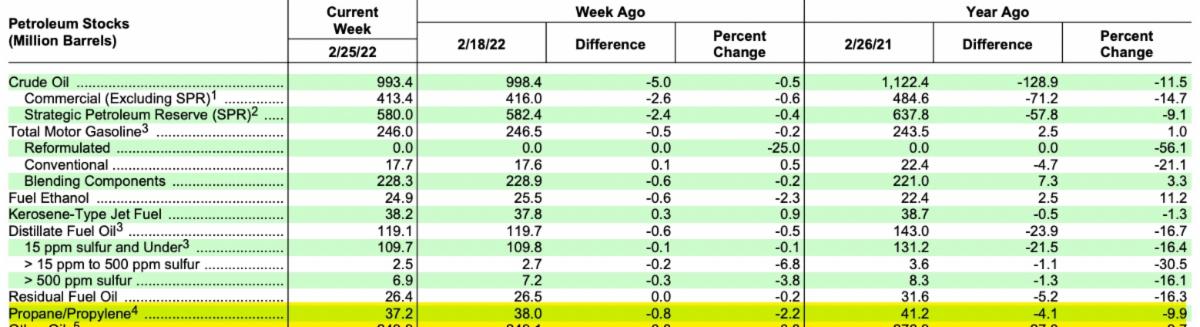

Inventories drew 800,000/bbls last week, as domestic demand saw a steep drop despite exports being flat week over week.

National inventories now stand at 37.2M/bbls, compared to 41.2M/bbls one year ago this week.

Given the incredible rise of crude oil values due to the ongoing war in Ukraine, propane flat prices did not rise as much as crude has risen in recent days, but is still near the 2021 highs we saw in late fall.

Crude was trading over $111/bbl early this morning but is back below $108/bbl as of this writing. Propane flat price values are now north of $1.5000 at both Conway and TET, which is a sharp rise from yesterday. So while yesterday’s propane values lagged behind crude, it looks as though they are ‘making up’ for it today.

The propane export trading arb also appears favorable for more propane to leave the US this month, given the steep rise in crude oil pricing. Propane values would need to rise to close that arb down…this was the last full reporting week for February…where propane inventories end March is anyone’s guess, but most every underlying fundamental factor that can impact propane prices to the upside is bullish at this present time. War can do that, coupled with historically low inventory levels.

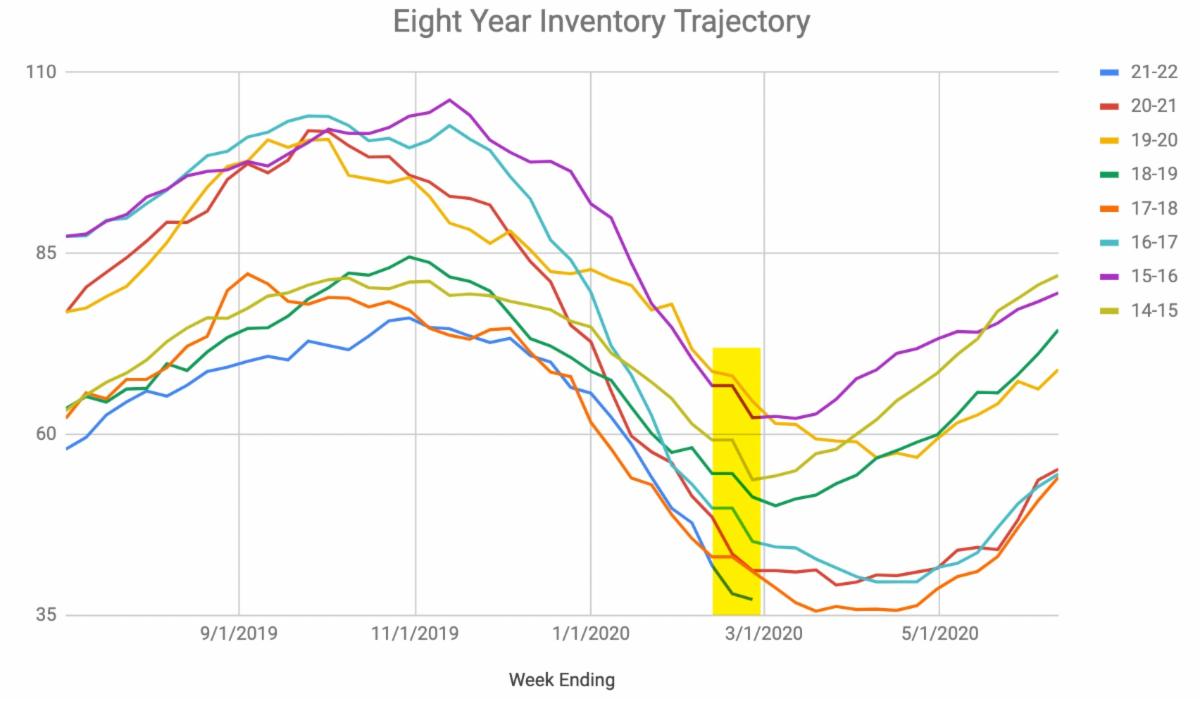

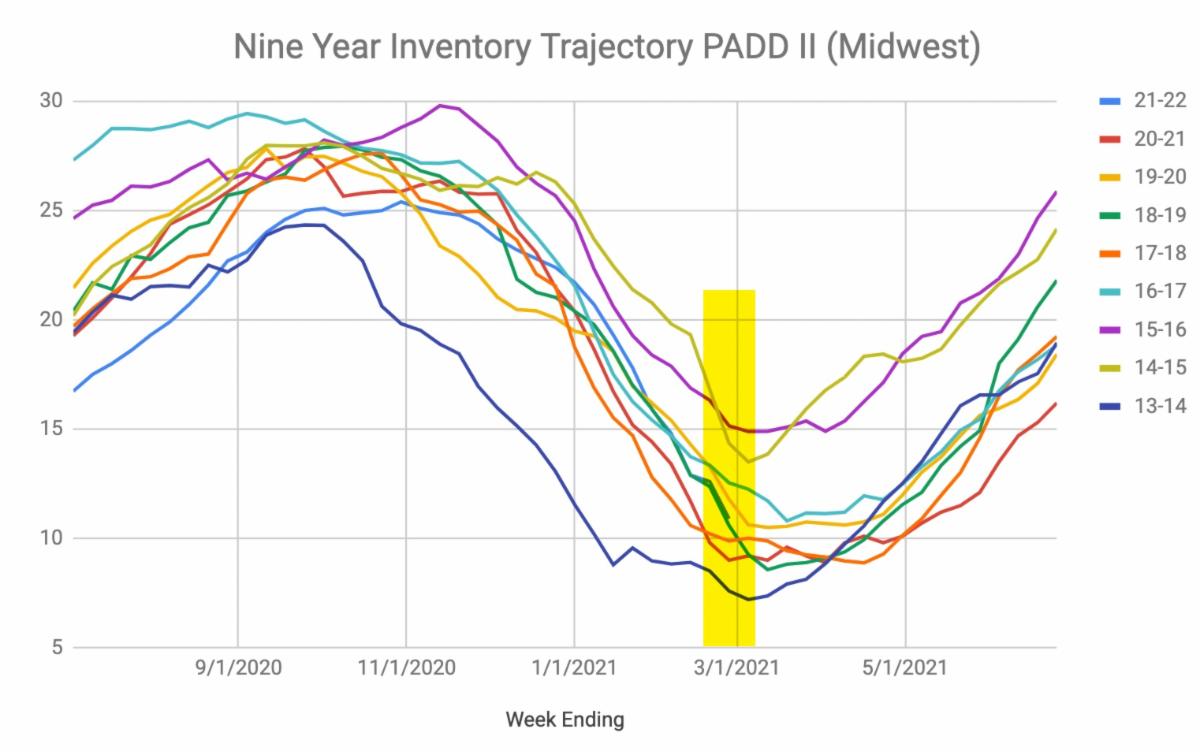

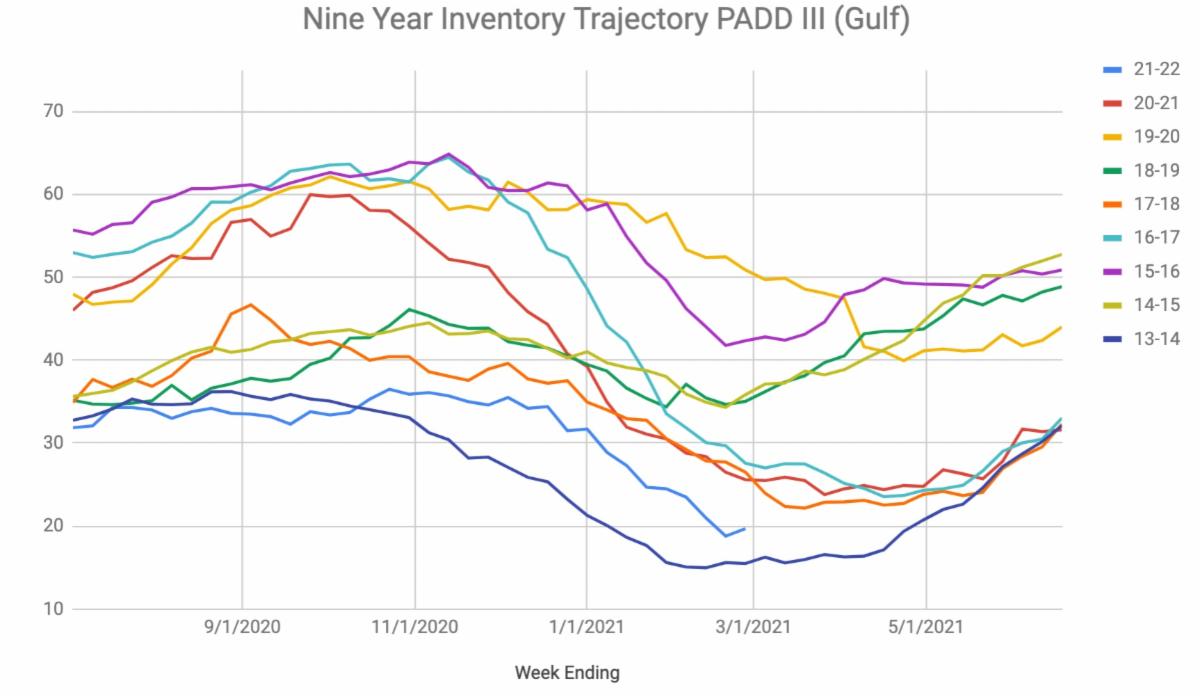

As things stand, the fundamental outlook for propane prices are incredibly bullish. We have inventories at the bottom end of seasonal averages, we may be heading into the next inventory building season with inventory levels reaching their lowest levels on record while we have the most significant geopolitical unrest since at least the second Gulf War, but the greatest ground invasion force involved in active war since 1939.

We have all woken up in a different world today…something we could say two years ago as COVID-19 began to wreak havoc upon the planet. This time, the black swan event was premeditated and intentional. The Western world continues to analyze and measure what their responses will be to Russia’s unprovoked aggression against Ukraine….and then, what will Russia’s response to the Western World be?

The stock market appears is turmoil, commodities are soaring and volatility reigns.