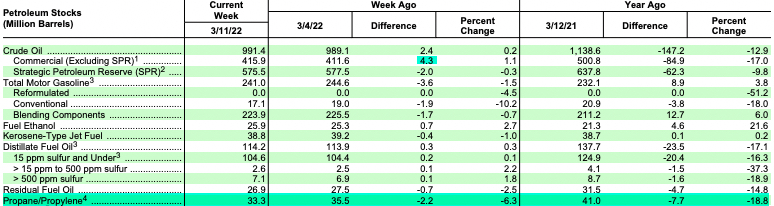

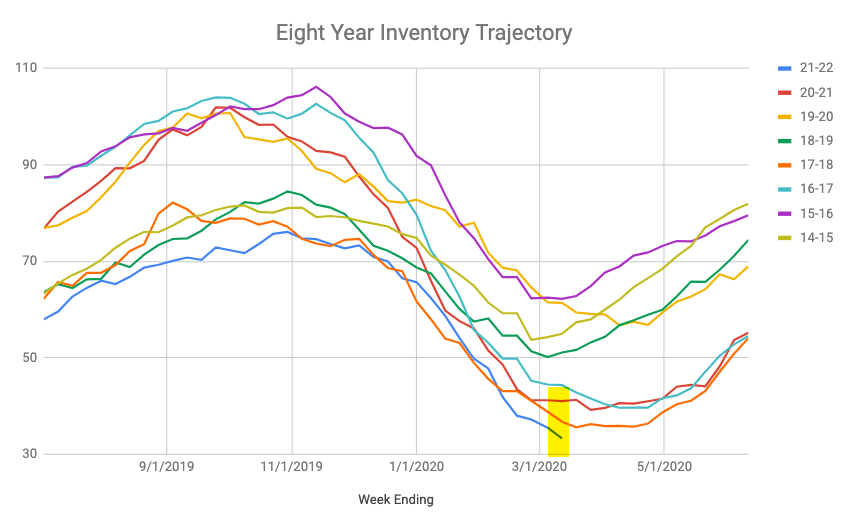

Inventories drew 2.2 M/bbls for the week ending March 11th, 2022.

National inventory levels now sit at 33.3M/bbls, which is the low point for this time on the calendar for the past eight years. The next lowest year was 2018, with inventories listed at 36.76M/bbls. That year, inventories dipped down to 35.6M/bbls the next week to reach the previous low-point over the eight years worth of data I have.

The forecast is certainly warming up, so who knows what type of numbers we will see next week, or if exports will tick back up; they were at 1.29M/bpd this past week, after being at 1.503M/bpd the week before.

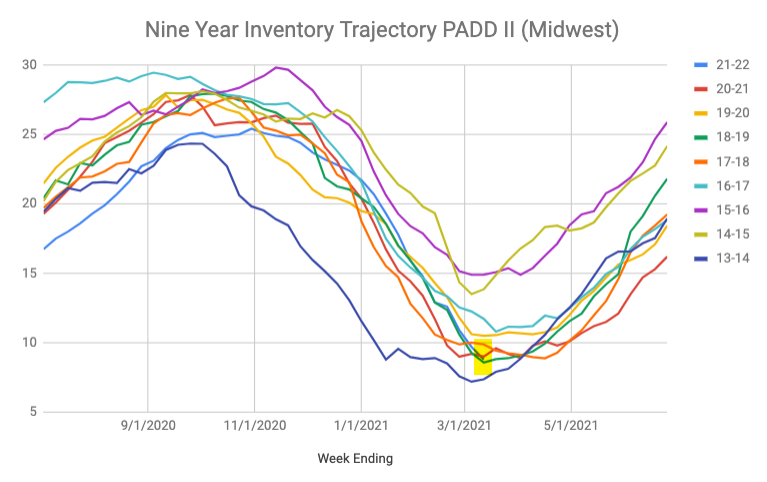

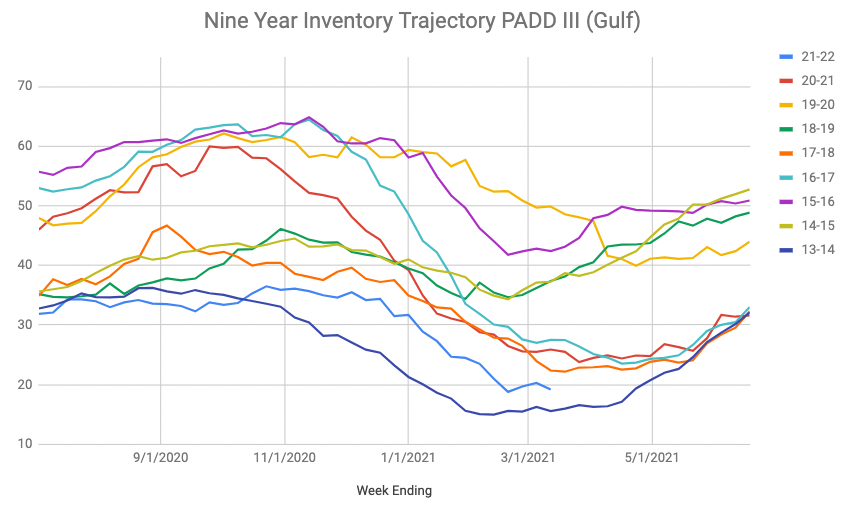

Midwest inventories were shown to be down to 8.8M/bbls. The lowest level for this week on the EIA calendar over the past nine years was 7.37M/bbls in March of 2014…that was on the heels of one of the coldest winters in decades and most people in the industry believe that Conway was sucking brine around Martin Luther King Day of that year. Gulf inventories are at 19.2M/bbls, and that is also the second lowest level for this time on the calendar over the past nine years, behind 2014 when inventories were at 15.58M/bbls, but likely lower due to the propylene being included in those numbers.

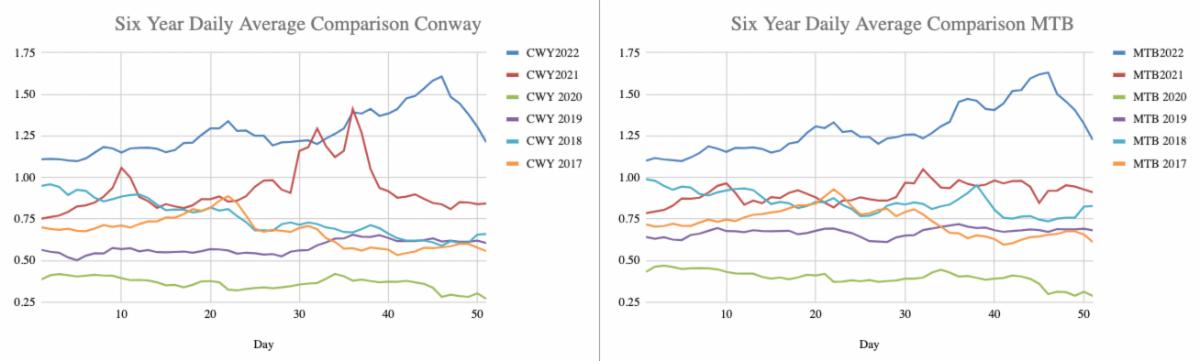

Flat price propane values took a nose dive yesterday, with averages in Conway and TET closing in the $1.2100-$1.2250 range, which is a near $.40/cpg drop from their highs back on March 8th, just one week earlier. While the front month has taken a nose dive, the out months have not dropped as far…but they had not risen as high, either.