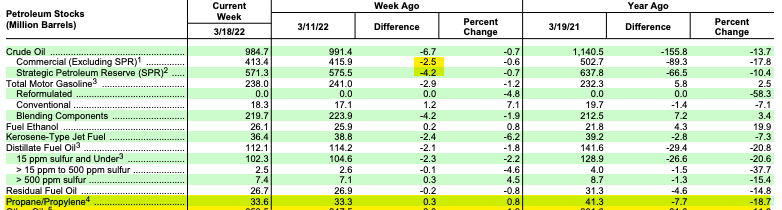

Propane inventories built for just the second week since late October, with the EIA reporting 300,000/bbls of propane being added to the US stockpiles.

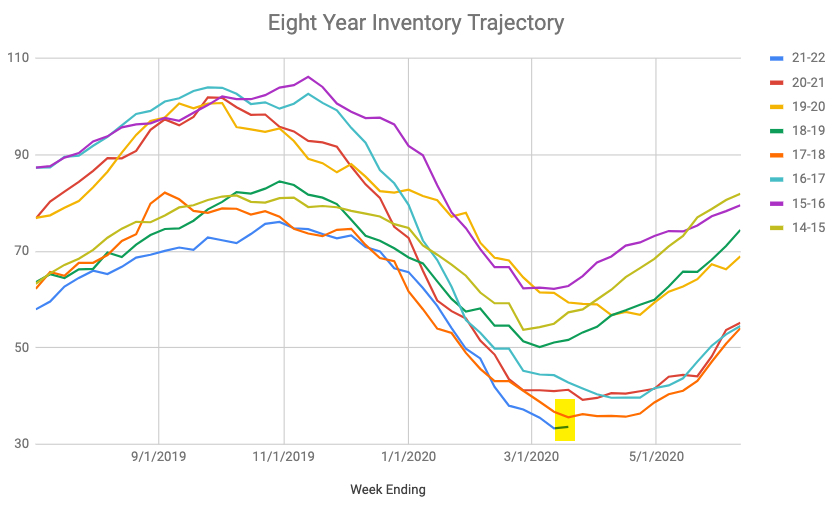

National inventory levels now sit at 33.6M/bbls, which is the low point for this time on the calendar for the past eight years. The next lowest year was 2018, with inventories listed at 35.6M/bbls, which was the low water mark for that year and the previous low-point among the past eight years.

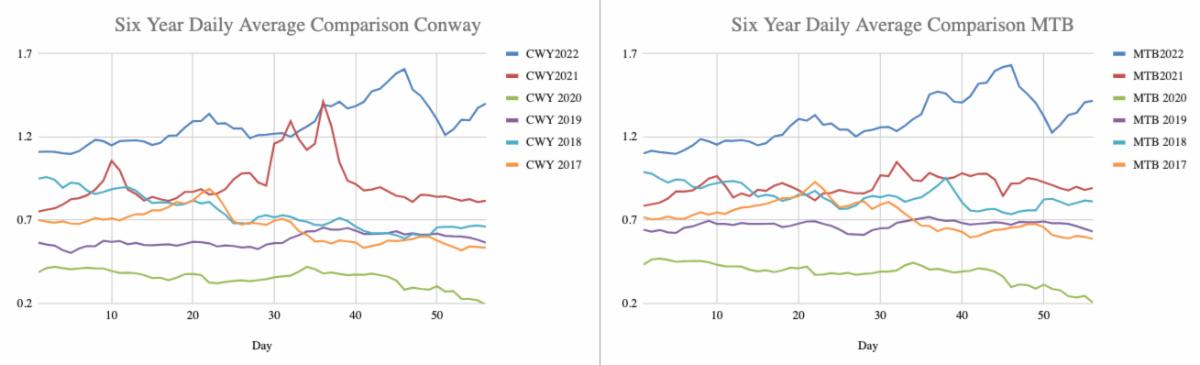

Exports checked in at 1.13M/bpd this week, falling from last week’s 1.29M/bpd.

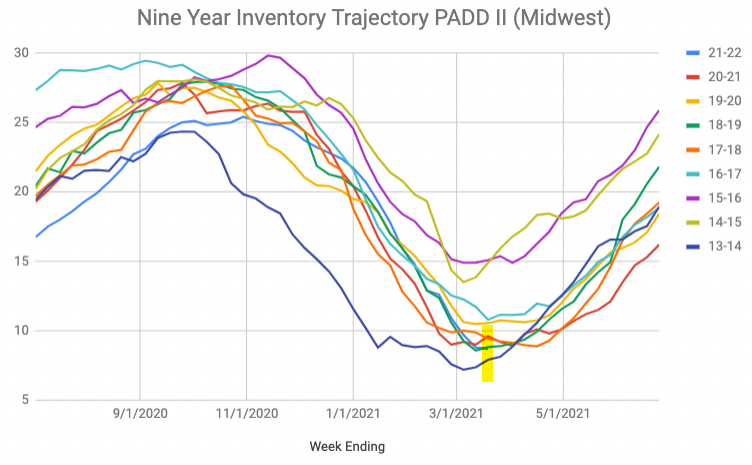

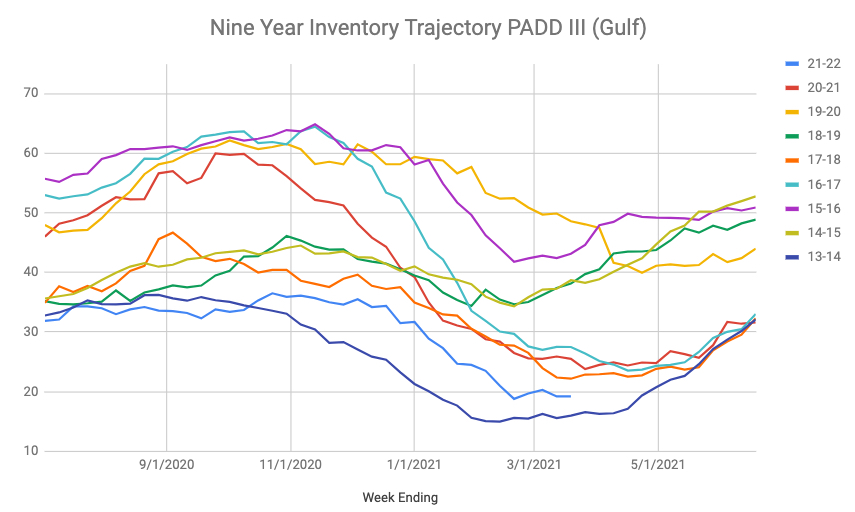

Midwest inventories were shown to be down to 8.7M/bbls, or 100,000/bbls lower than last week..Gulf inventories are at 19.2M/bbls, and that is also the second lowest level for this time on the calendar over the past nine years, but also unchanged from last week.

WTI closed at $111.76 yesterday and is trading north of $114/bbl post report. This was a bullish report for crude and refined products, but energies has been stronger prior to the report due to some reports of storm damage to a Kazakhstan shipping port that could result in a reduction of crude oil exports for an unknown amount of time, perhaps up to 1M/bpd…possibly as long as months. Given the tight global supply situation, something like that can really move the pricing needle. Propane values were up a nickel this morning before the report and are holding those gains.