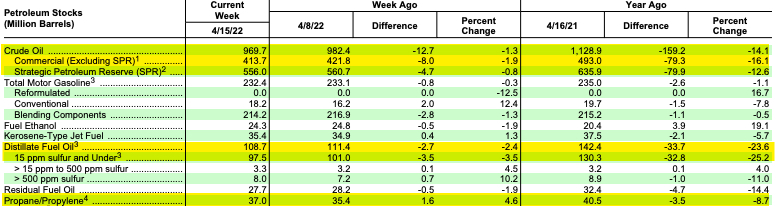

Propane inventories built 1.M/bbls for the week ending April 15th, 2022.

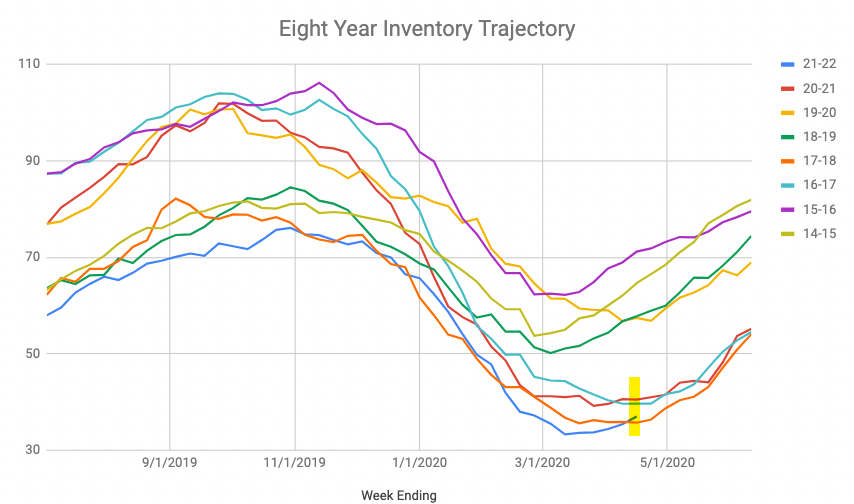

National inventory levels now sit at 37M/bbls, which is a bit higher than where they were this week in 2018 but still on the low end for Shale Era levels for this date on the calendar. Propane inventories are 8.7% lower now than where they were a year ago, and low propane inventories were the big story one year ago.

Exports were off significantly this week to 1.205M/bpd from last week’s 1.57M/bpd, but in line with where they were two weeks ago at 1.211/bpd…perhaps last week’s totals were an outlier relative to some spot cargoes that left the US for foreign lands.

The bigger story for this weeks report is the continued bullishness in crude oil and distillates. US crude inventories are 15% below where they were one year ago this week, while distillate inventories are nearly 25% lower than where they were one year ago this week. Diesel is the life blood of American industry…and with inventories as low as they are, it does not spell an end to inflation any time soon, and the costs to deliver propane will remain elevated with record high fuel surcharges.

As far as regions of the country go, propane drew over 300,000/bbls this past week in Conway, which has Conway/Midwest inventories at 8.7M/bbls, which is the lowest number for this time of year among the last nine years. Conway values are stronger, post-report.

Jon Miller and Chris Cox of Flashpoint Energy Partners discuss the latest EIA Inventory report, the challenges that retailers will face for this upcoming supply season in addition to extending invitation to you to meet with them in Nashville this coming weekend. CLICK HERE to watch the video, or click on the image on the right to do the same.