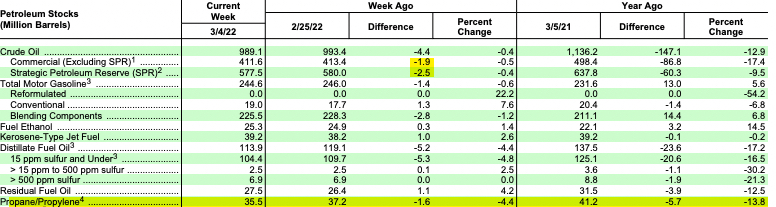

Inventories drew 1.6M/bbls last week, much of that coming from exports at over 1.5M/bpd.

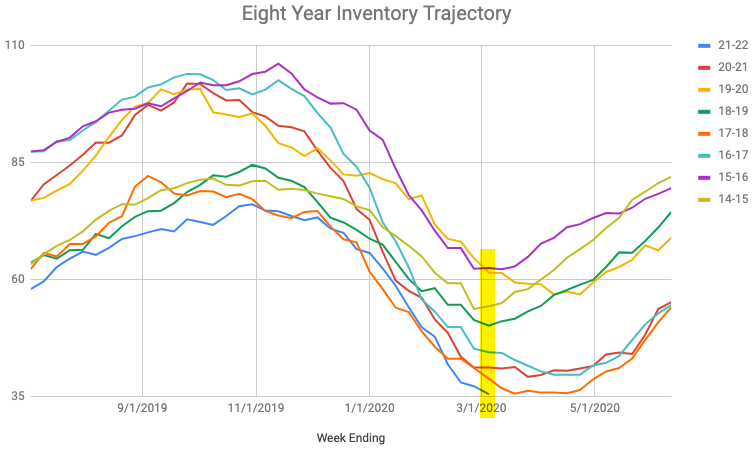

National inventories now stand at 35.5M/bbls, which is the lowest inventory level over the past eight years for this time of year*.

Once again, the asterisk relates to propylene no longer being counted in propane inventories, when it was prior to 2020-2021.

Inventories were at 38.82M/bbls for this same reporting week in 2018…so there is a chance that pure propane inventories were lower then than they are now…and if so, not by much.

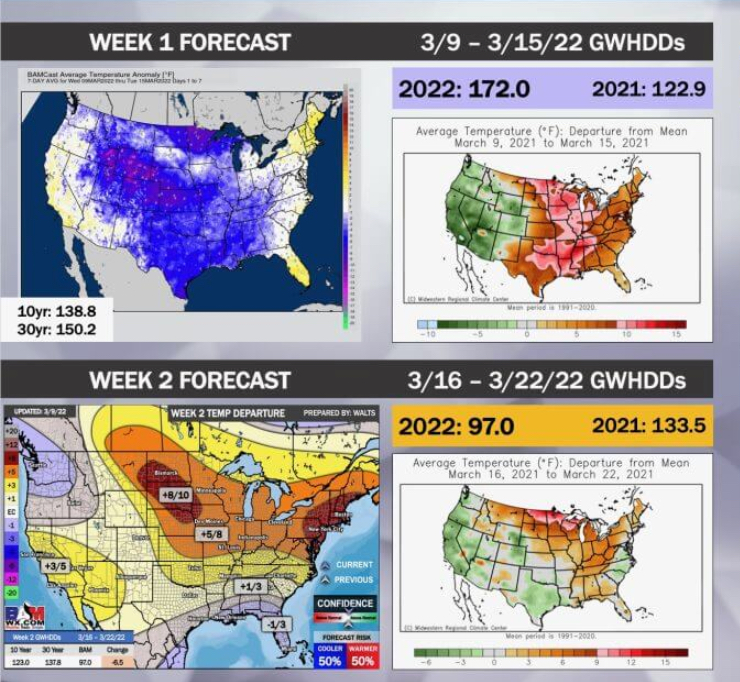

Regardless, we are very low on the inventory side of things, getting closer to the time of year when we begin building…and for the second year in a row, we will begin building from a low level…this was the primary driving force behind the price run up of last summer and early fall that saw propane spot hub values trading over $1.5000/cpg. That also took place without the largest land war in 80 years taking place…and crude oil values were at $65.05/bbl one year ago, and not north of $118/bbl as they are relative to this writing, and we didn’t have bans on Russian energy exports, and Russia wasn’t banning exports to the US.

I think you get the picture:

- Propane fundamentals are very bullish in and of themselves

- War volatility is at an unprecedented level in modern times

- US crude inventories are 13% lower right now than the five-year average

Propane and oil values soared yesterday, pulled back late, but have pulled back quite a bit this morning. I think we will continues to see a yo-yo impact with wild volatility swings as long as the war goes on in Ukraine. The only ‘downside risks’ to price seem to be:

- Prices get so high that demand gets destroyed

- Peace….that is what is meant with the image on the right. Then again, I think the world would be a better place with more Beatles, too.

![]()