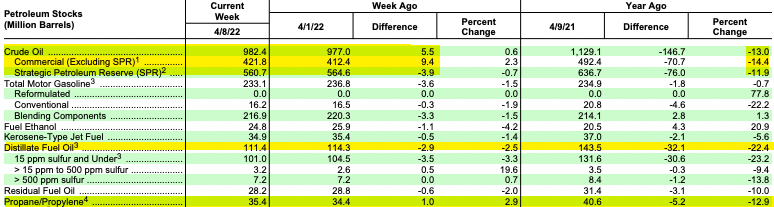

Propane inventories built 1M/bbls for the week ending April 8th, 2022.

National inventory levels now sit at 35.4M/bbls, which remains the low point for this time on the calendar for the past eight years. The next lowest year was 2018, with inventories listed at 35.87M/bbls, but as we have been repeating, the 2018 totals included propylene so our current inventory level is likely the second lowest for this time of year of the Shale Era.

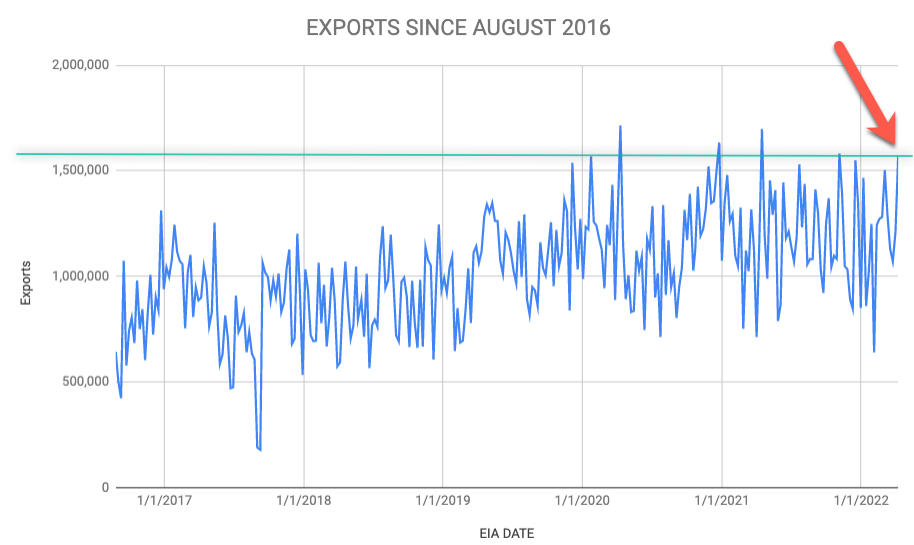

Exports were up sharply this this week at 1.57M/bpd, compared to 1.211M/bpd last week. Production was flat and domestic demand was off sharply, down over 450,000/bpd to 828,000/bpd. There were some rumors of spot cargoes leaving port last week, and perhaps those rumors showed up in this week’s export totals.

Taking a closer look at the export numbers, you can see in the chart that this week’s export total of 1.59M/bpd is the fifth highest export number that has ever been reported by the EIA.

Of course, we can only go off of these reports, and these numbers are sometimes adjusted months later, but the week to week numbers are definitely indicative of what is taking place. Obviously, if exports were the same this week as last week, we would have seen a propane build more like 2.5M to 3M/bbls. But exports soaked that up.

This will be one of the biggest propane stories of 2022…will exports remain strong? Will exports limit how quickly or how high United States propane inventories can reach come late September or October? If exports were to remain north of say 1.4M/bpd for the next month or so, propane inventories will be hard pressed to make it back to last year’s end of build cycle, which was 76.1M/bbls…and the markets told us quite bluntly last year that they were worried about propane inventories at those levels, and we saw propane values at both hubs trading over $1.50/cpg in early October of 2021.

Instead of spending time thinking about where current propane inventories are compared to 2018, the focus needs turn to where propane inventories compare year over year, considering the aforementioned fact at how the markets reacted to propane inventories one year ago, when the markets deemed that inventories were perilously low and price reacted as much. Current propane inventories are nearly 13% lower for this week on the calendar than they were one year ago.

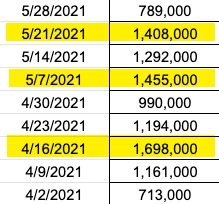

It should be said that we saw an export ‘anomaly’ nearly one year ago. The image shows the export totals for early spring of last year, as reported by the EIA for that given week. From 1/1/21 through 4/9/21, exports had averaged 1.143M/bpd. This year, for the same span of time, exports have averaged 1.2M/bpd, or 57,000/bpd stronger than one year ago.

While 57,000/bpd doesn’t seem like a large number, we have 170 days until September 30th. IF we had a 57,000/bpd increase in exports for the rest of this year over the same time frame last year, that is nearly 10,000,000 additional barrels of propane leaving the United States for exports abroad. We would need to see more propane production or less demand (in the form of petrochemical consumption by and large) to offset that delta.

None of us can know how this is going to play out, but I am betting on continued price volatility in propane, possibly severe. A friend sent me a podcast this morning that I listened to that spent a good chunk of time focusing on global economic supply chains, and specifically the energy industry. The title of the podcast episode is ‘Disorderly Markets, Margin Calls & Doom Loops’. The guest is Javier Blas, someone I have often cited in this blog, as he is the chief energy correspondent for Bloomberg. Here is the link to the podcast, which I strongly recommend you listening to, if for anything else, it backs up a great deal of what Chris Cox and I have been talking about on The Propane Buzzcast for over a year now. There are a lot of risks this year, and a great deal of risk for your business…but, we have a plan for that.

GOING TO NASHVILLE? So that end, if you are going to Nashville and would like to meet with the Flashpoint Energy Partner team to discuss supply, the propane industry or anything else to do with helping give your business the Flashpoint Edge, click on this link to schedule a time to meet with us between April 23rd through the night on April 25th. Jon Miller, Chris Cox, Darius Lechtenberger and Nick Dawson will be there and we’d love to speak with you. The coming year in propane is shaping up to be one of the most challenging on record, but we have a plan for that! We have rented a loft just a block or so off Broadway, the address is 218 3rd Avenue

North Nashville, TN 37201. Someone will typically be there and refreshments will be available for those who just want to drop by and say hello, but if you want to take a deeper dive and talk shop, use the scheduling link above. We are looking forward to seeing you!