“WTI crude oil and refined product prices are weaker this morning as rumors swirl about the U.S. and Iran getting very close to finalizing a new nuclear agreement. If the U.S. is onboard with a new agreement, it is expected that all Iranian economic sanctions will be lifted and Iranian crude oil will be allowed back onto the open market adding to the global crude supply. Although to counter any bearish news being generated by Iran, is the Ukraine/Russia “impending” conflict. Two days ago it was being reported that Russia was withdrawing troops from the Ukrainian boarder, but NATO and President Biden say they have not seen any evidence of any troop withdrawals. Biden warned that a Russian invasion of Ukraine will have painful consequences for energy consumers as energy prices will surely rise. Biden is still fixated on not engaging U.S. energy producers, but rather looking to OPEC+ to make up any energy shortfall. OPEC+ can’t raise production substantially without Saudi Arabia as the Saudis hold most of the available spare crude oil production capacity and Saudi Arabia won’t budge without Biden talking to Saudi Crown Prince bin Salman…Biden refuses to talk to the Crown Prince because he believes bin Salman had a hand in the murder of a Saudi journalist two years ago… A blast of winter weather is hitting the Midwest today as heavy snow and cold temperatures are being forecast throughout the Midwest. Propane prices were quite strong yesterday following WTI crude oil price upward, I expect propane prices to give back some of yesterday’s gain as WTI crude oil and refined product prices retreat.”

Darius mentioned US-Iranian negotiations. There was a tweet last night from an Iranian oil minister that read, ‘After weeks of intense talks, we are closer than ever to an agreement; but nothing is final until the agreement is final. Our negotiating partners need to be realistic, avoid intransigence and heed lessons of the past four years.” I will admit to learning a new word today; intransigence, which is defined as ‘refusal to change one’s view or to agree about something.’ At any rate, the global market believes the world needs this Iranian supply…if the deal breaks apart, oil prices are likely to head back higher. They are trading just over $91/bbl as I write this, after closing yesterday at $93.66.

![]()

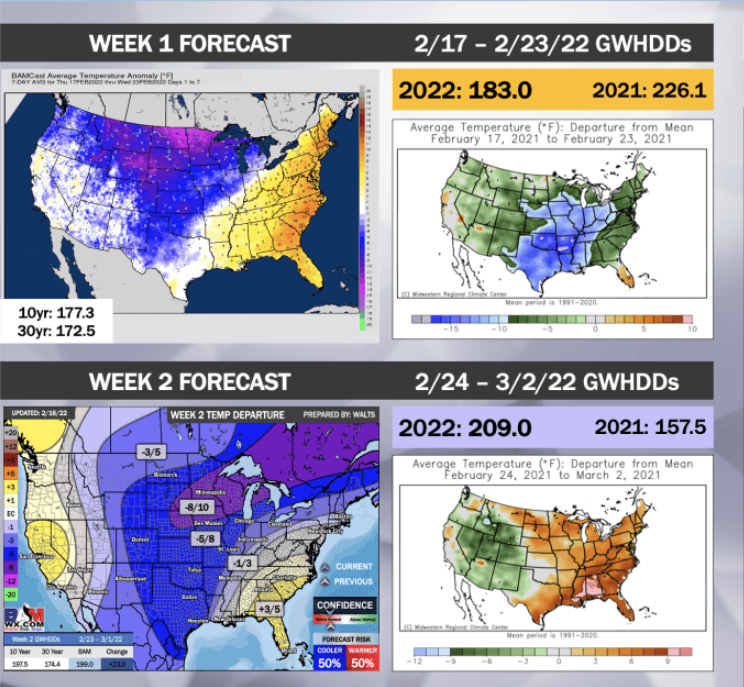

The back half of February looks to be getting even colder in the computer model runs

Week 1:

Warmer air in the short-term in the E. US will give way to cooler air in the Eastern US this weekend.

However, warmer than normal temperatures (much warmer than normal in the E. US early – mid next week) return early next week leading up to our next storm system that looks to produce a more widespread shot of cold air.

By day 6/7 very cold air will drop into the Central and Northern US taking HDDs above normal.

Week 2:

Into the week 2 period, cold air will settle in for the northern and central US.

Some warmer than normal temperatures in the Southeastern US continued ahead of storm systems and if there is a risk to the forecast it’s that storms enhance storm induced E. US warmth more than modeled.

However, we also continued to see –EPO/+PNA signals which should eventually allow the cold air to seep further south and east and ultimately keep HDDs well above normal.

As far as the duration of the cold, we have another storm system in early March so a brief moderation ahead of that system cannot be ruled out, but as far as a pattern change back to more widespread warmer risks, it’s likely not until the week’s ¾ period given an SOI drop which correlates to colder risks and colder signals on East Asia persisting through at least ~March 5th. On tap of that, data is backing off on warmer MJO signals which might make the transition to warm gradual rather than immediate. With that said, we made our risk slightly warmer given storm induced warmth risks ahead of storms.