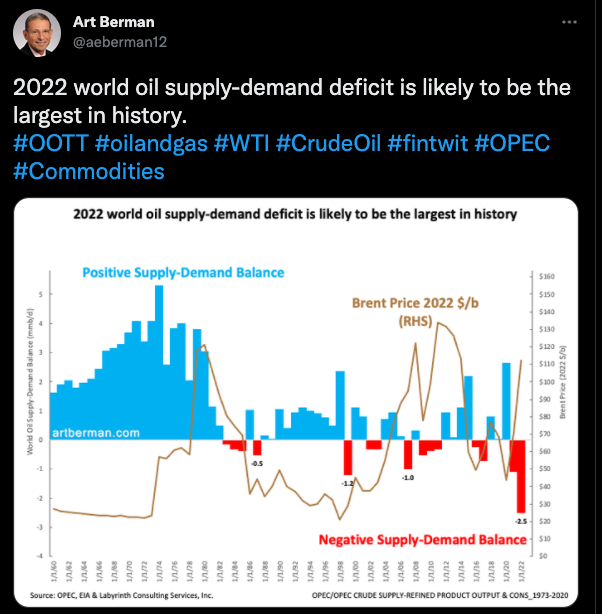

First up this morning, a screen shot from Art Berman. Berman is a geologist by trade but has become a prominent voice relative to oil and gas supply and demand fundamentals.

If Berman’s assertions relative to the data come to pass, and it seems like a fairly decent bet that they will, we would likely continue to see a volatile price environment in propane along with all energies…that doesn’t mean there wouldn’t be opportunities to buy some dips…but back and forth price volatility just seems to be baked into our foreseeable future, given world events, ongoing COVID concerns and potential associated demand destruction and then the organic demand destruction that can accompany high gas and diesel prices, which would fuel even stronger, or tougher to get rid of, inflation.

Next, a note from Flashpoint’s Darius Lechtenberger:

“WTI crude oil and gasoline prices are slightly weaker this morning as diesel prices continue to move up. Yesterday’s price run up was thought to be sparked by storm damage to a shipping port in Kazakhstan, but also helping support the price run was Putin starting to weaponize Russia’s natural gas supplies. The following is an excerpt from a Seeking Alpha story this morning explaining the situation, “The energy war between Russia and the West is heating up after President Vladimir Putin demanded that natural gas sold to “unfriendly” countries be paid for in rubles. The Russian currency gained 7% against the dollar immediately after the announcement. While it’s possible for Russia to devise new contracts that require ruble payments, it would demand that Western governments hold rubles in their central banks or buy them on the open market, which would be seen as skirting financial sanctions. Both sides would lose if the gas stops flowing, with Putin missing out on cash for his flailing domestic economy and the West needing to secure pricier supplies elsewhere. Putin may also be trying to chip away at dollar dominance in global trade, which could have long-term implications for American borrowing and financing costs.” The plot continues to thicken. Cooler weather forecasts look to prolong winter demand into the first half of April and as a result, propane inventories are probably not yet done drawing down for this winter.”

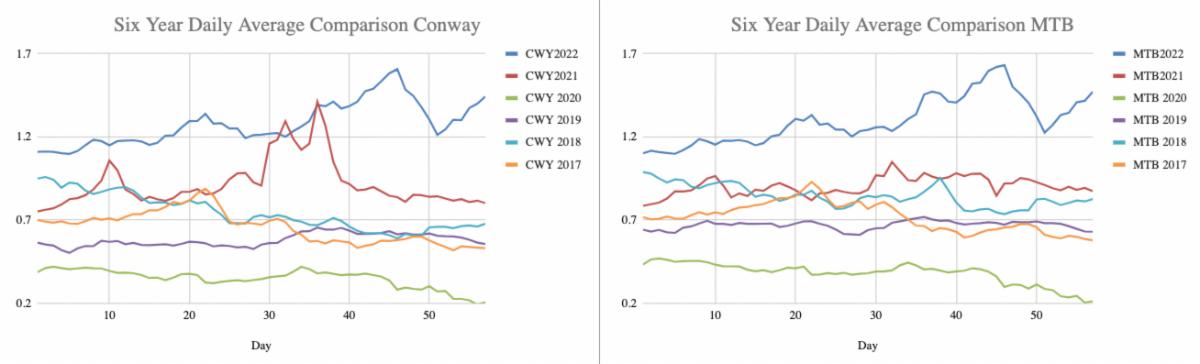

Propane values were back into the mid to upper $1.4000’s yesterday for the front months at both Conway and TET.