A quick market snapshot from Flashpoint’s Darius Lechtenberger:

“WTI crude oil and refined product prices are a mixed bag this morning. Russian President Vladimir Putin’s edict to pay for Russian oil and gas only with rubles is starting to yield consequences. Yesterday, crude oil prices and diesel prices soared after reports came out that Russia cut off the natural gas supply to Poland and later to Bulgaria out of concern that the reduced supply of natural gas to Europe will force the continent to use alternative forms of energy, mainly crude oil and diesel which already are globally undersupplied. At this point, Bulgaria, Poland and Germany are standing firm refusing to pay Russia in rubles. It appears that some European countries have decided to give in to Putin and pay for their natural gas in rubles, but this has not yet appeased the Russian government which is demanding that all countries give in to their demands or get their supply cut off. OPEC+ continues to maintain their long-term production plans and supports Russia by refusing to raise production despite high prices and indicating it will not replace any Russian production that has been lost due to sanctions. Propane prices seem to take one “one step back” and “two steps forward” every time there is a significant price pullback as retail demand steps in quickly to buy on price dips pushing prices back.“

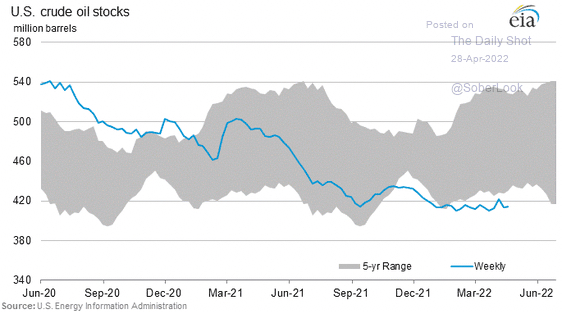

The image above shows US crude inventory levels…as you can see from the blue line, we are below the five-year average right now.